What if you could send money to someone who has no internet, no smartphone, and no bank account — and they could spend it at a local market within seconds? That was the question we set out to answer when we built our SMS-based blockchain wallet and took it to Cusco, Peru for a real-world pilot in August 2024.

The Problem: Aid Distribution in Disconnected Areas

Globally, $54.9 billion in humanitarian aid was distributed in 2023 alone. Yet a significant portion of that aid never reaches the people who need it most — those living in areas with no banking infrastructure, unreliable internet, or limited access to smartphones. Every 1% reduction in distribution costs saves $55 million. The question isn't whether technology can help — it's whether it can work where infrastructure doesn't exist.

Our Solution: A Smart Wallet for Basic Phones

We built a blockchain-based digital wallet that operates entirely via SMS. Using account abstraction on the Polygon network, we created a system where users can perform every wallet operation — from account creation to peer-to-peer transfers — by sending and receiving text messages. No app download. No internet connection. No cryptocurrency knowledge required.

What Users Can Do

- Create a smart wallet instantly by sending an SMS

- Check their balance via text message

- Send and receive stablecoins (USDT/USDC) peer-to-peer

- Make purchases at physical stores using a one-time passcode (OTP)

- View their transaction history and account address

- Update their phone number if needed

What Organizations Can Do

- Create wallets in bulk using only beneficiaries' phone numbers

- Distribute funds with full on-chain traceability

- Monitor every transaction through a block explorer

- Reduce overhead costs compared to traditional cash distribution

How a Transaction Works

The payment flow was designed to be intuitive for both buyers and sellers, even if neither has ever interacted with blockchain technology.

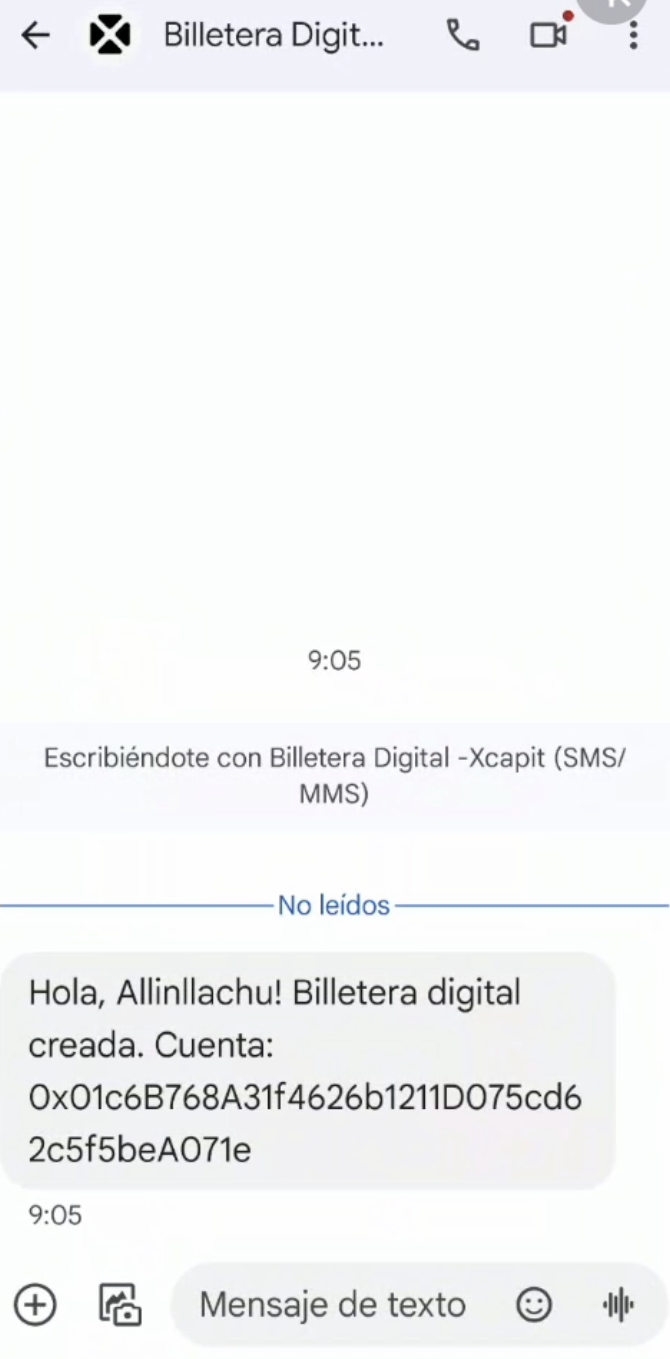

- Step 1: The customer receives an SMS confirming their digital wallet has been created — no app or internet needed.

- Step 2: At the point of sale, the seller enters the customer's phone number, purchase amount, and order details on a simple web platform.

- Step 3: The customer receives an SMS with a one-time passcode (OTP) and the transaction details.

- Step 4: The seller enters the OTP on the platform to verify and complete the transaction.

- Step 5: The customer receives a final SMS confirming the purchase, including the on-chain transaction hash.

For peer-to-peer transfers, the process is even simpler: the sender texts the amount and recipient's address, and both parties receive an SMS with the transaction hash. All secure, all on-chain, all without internet.

The Cusco Pilot: Real Users, Real Transactions

In August 2024, we traveled to Cusco, Peru to test the wallet with real users in real conditions. We chose Cusco because it represents a realistic environment for humanitarian aid distribution — a region where many people rely on basic phones, internet connectivity is inconsistent, and traditional banking services are limited in rural areas.

Key Results

- 100% success rate in all transactions — every transfer and purchase completed without errors.

- Funds were successfully distributed to unbanked individuals without smartphones or internet access in just seconds.

- Users made purchases at the Plaza de Armas in Cusco and at local markets — buying fruits, sweets, chocolates, water, and snacks.

- The smallest transaction was just $0.10, proving the system works for micro-payments.

- 10 real purchases were completed, totaling $18.25 in USDT and USDC.

- Native language support was included, with wallet messages delivered in Quechua — greeting users with 'Hola, Allinllachu!' upon wallet creation.

Transaction Costs

One of the most important metrics for any aid distribution system is cost efficiency. Our pilot demonstrated extremely low transaction costs:

- Blockchain gas fees: $0.01 average per operation (19 operations, $0.15 total on Polygon).

- SMS costs via Twilio: $0.13 per outbound message to Peru, $0.0079 per inbound message.

- Total cost per purchase (gas + SMS): approximately $0.27 — a fraction of traditional remittance fees.

Why This Matters

The Cusco pilot proved something that many in the blockchain space have theorized but few have demonstrated in practice: blockchain technology can serve the most underserved populations, not despite their lack of technology, but by meeting them exactly where they are — with a basic phone and a text message.

For humanitarian organizations, this means funds can be distributed with full transparency and traceability at a fraction of the cost of traditional methods. For end users, it means access to a digital wallet without the barriers of smartphones, internet connectivity, or technical literacy.

The Technology Behind It

Under the hood, the wallet leverages account abstraction on the Polygon blockchain, allowing us to create and manage smart contract wallets tied to phone numbers rather than private keys. Twilio handles SMS communication, and a merchant platform enables sellers to process payments through a simple web interface. Every transaction is verifiable on-chain through Polygonscan, providing complete auditability.

What's Next

The Cusco pilot was a proof of concept, but the implications extend far beyond a single city. We're working to bring this technology to humanitarian aid programs, financial inclusion initiatives, and crisis-response scenarios where traditional infrastructure has failed. If your organization is working on aid distribution, financial access, or digital inclusion for underserved communities, we'd love to explore how this technology can help.

Antonella Perrone

COO

Previously at Deloitte, with a background in corporate finance and global business. Leader in leveraging blockchain for social good, featured speaker at UNGA78, SXSW 2024, and Republic.

Let's build something great

AI, blockchain & custom software — tailored for your business.

Get in touchBuilding on blockchain?

Tokenization, smart contracts, DeFi — we've shipped it all.

Related Articles

Blockchain for Social Impact: Lessons from Building with UNICEF

What we learned building blockchain-based financial inclusion tools with the UNICEF Innovation Fund — from designing for low-connectivity environments to navigating regulatory complexity and measuring what actually matters.

Alternative Collateral: How Blockchain Can Unlock Credit for the Unbanked

How blockchain-based stablecoin collateral can give millions of rejected credit applicants their first card — with real results from a pilot in Argentina.